Fizzy Tornado: Whirlwind of News

Dive into a whirlwind of intriguing news and fascinating information from around the globe.

Dollars and Sense: Navigating the Maze of Deposit and Withdrawal Methods

Unravel the secrets of deposit and withdrawal methods! Discover tips, tricks, and the best strategies to maximize your financial success.

Understanding the Pros and Cons of Popular Deposit Methods

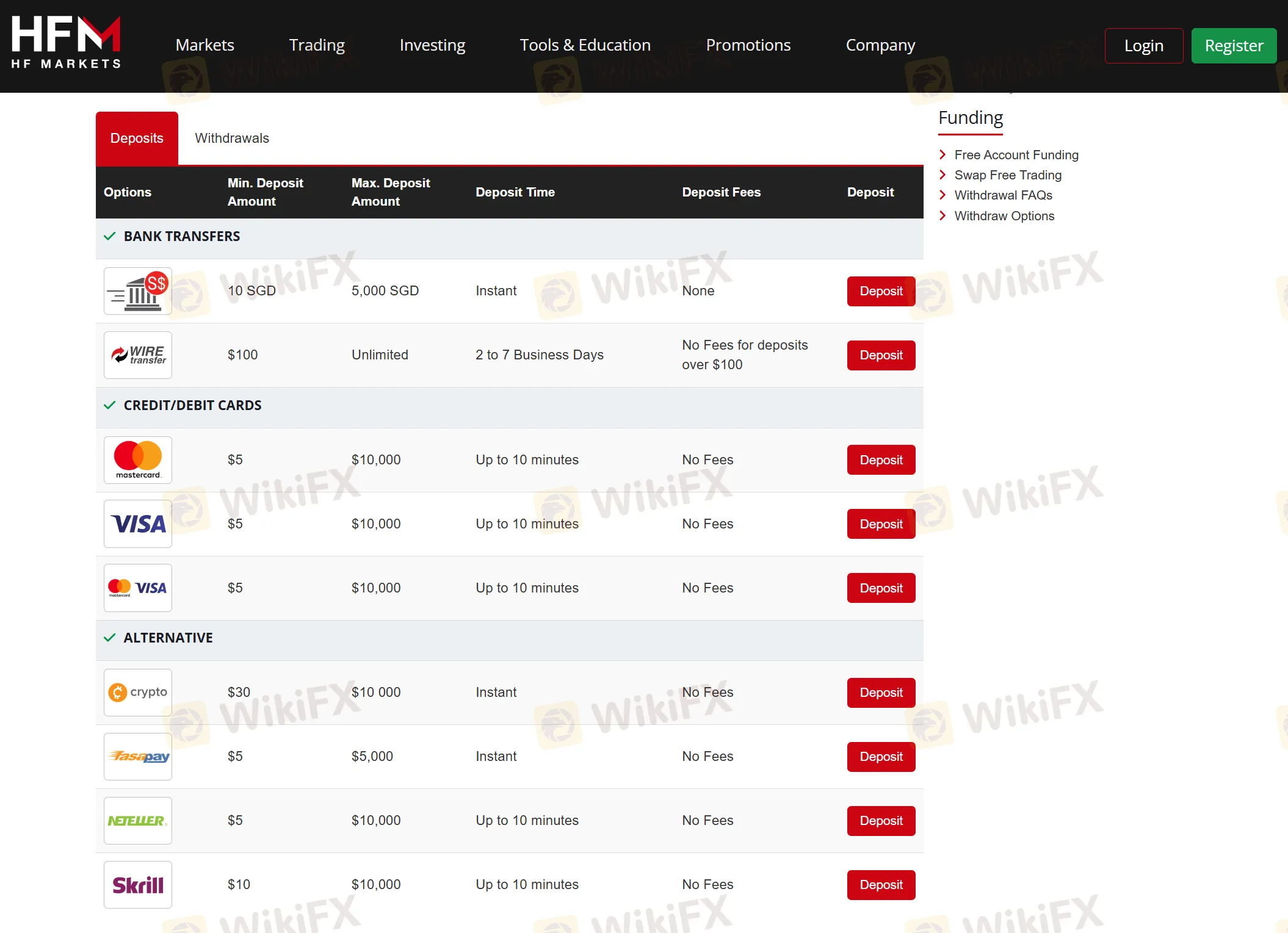

When it comes to managing finances online, understanding the pros and cons of popular deposit methods is crucial for making informed decisions. Each deposit method, whether it be credit/debit cards, bank transfers, e-wallets, or cryptocurrencies, comes with its own set of advantages and disadvantages. For instance, credit and debit cards are often favored for their convenience and instant processing times, enabling users to fund their accounts quickly. However, they may incur higher fees and provide less privacy compared to other methods. On the other hand, bank transfers, while generally secure and offering higher deposit limits, can take several days to process, causing delays in funding.

Another popular option is e-wallets, which are gaining traction due to their speed and increased security. Using e-wallets allows users to deposit money without sharing their banking information directly with merchants. However, not all platforms accept e-wallets, which may limit options for some users. Lastly, cryptocurrencies present an innovative alternative, offering anonymity and lower transaction fees. Nonetheless, the volatility of digital currencies can pose a risk, making them less suitable for those seeking stability in their deposit methods. Thus, weighing these pros and cons is essential for anyone looking to choose the best way to fund their online activities.

Don't miss out on the latest offers! Use our shuffle promo code to get exclusive discounts on your next purchase.

How to Choose the Best Withdrawal Method for Your Needs

Choosing the best withdrawal method for your needs can significantly impact your overall experience when managing your finances. With numerous options available, it is essential to consider factors such as speed, fees, and security. Start by evaluating how quickly you want to access your funds; methods like e-wallets often provide instant access, whereas bank transfers may take several days. Next, assess the cost associated with each method, as some may charge higher fees than others. Lastly, prioritize security by opting for methods with robust encryption and fraud protection measures.

To help you navigate your options, here is a simple checklist to guide your decision:

- Identify your priorities: Whether it’s quick access, lower fees, or enhanced security.

- Research reliable providers: Look for reviews and rankings of withdrawal services.

- Test with a small amount: Before committing, try withdrawing a small sum to evaluate the process.

By considering these factors and following this checklist, you will be well-equipped to choose the best withdrawal method that aligns perfectly with your financial needs.

Deposit vs. Withdrawal: What Fees Should You Expect?

When navigating the world of online banking and financial transactions, understanding the differences between deposit and withdrawal fees is crucial. Deposits often come with a variety of processing fees, which can vary significantly based on the method used—be it credit card, bank transfer, or mobile payment. For instance, if you're depositing funds via a credit card, you might encounter higher fees compared to a direct bank transfer. Moreover, some financial institutions also impose a minimum deposit requirement, which can affect your transaction cost. Always review the terms and conditions of your bank or service platform to ensure you're aware of these potential fees.

On the other hand, withdrawals may also entail specific charges that can impact your overall financial strategy. Fees associated with withdrawals can differ based on the following:

- Method: Whether you choose to withdraw via ATM, bank transfer, or check.

- Frequency: Some banks might charge per transaction or offer a limited number of free withdrawals each month.

- Account Type: Premium accounts may benefit from lower or waived withdrawal fees.

Being aware of these factors can help you make informed decisions about how you manage your finances, ensuring that you minimize unnecessary expenses related to your banking activities.